Financial Literacy 101: The Essential Money Skills Every Adult Should Know

A clear and simple guide to the key financial skills every adult needs—budgeting, saving, investing, credit management, and smart spending habits.

Financial literacy isn’t about being a money expert. It’s about understanding the basics well enough to make smart decisions that protect your future. Sadly, many people were never taught how money really works—and that lack of knowledge often leads to stress, mistakes, and missed opportunities.

If you want to take control of your finances, here are the essential skills every adult should know.

1. Understanding Your Cash Flow

Financial literacy starts with knowing how much you earn, how much you spend, and where your money actually goes.

This helps you live within your means and avoid unnecessary debt.

2. Building Better Saving Habits

Saving is more than putting money aside—it’s about consistency.

Whether it’s a weekly amount or a percentage of your income, make saving a non-negotiable habit.

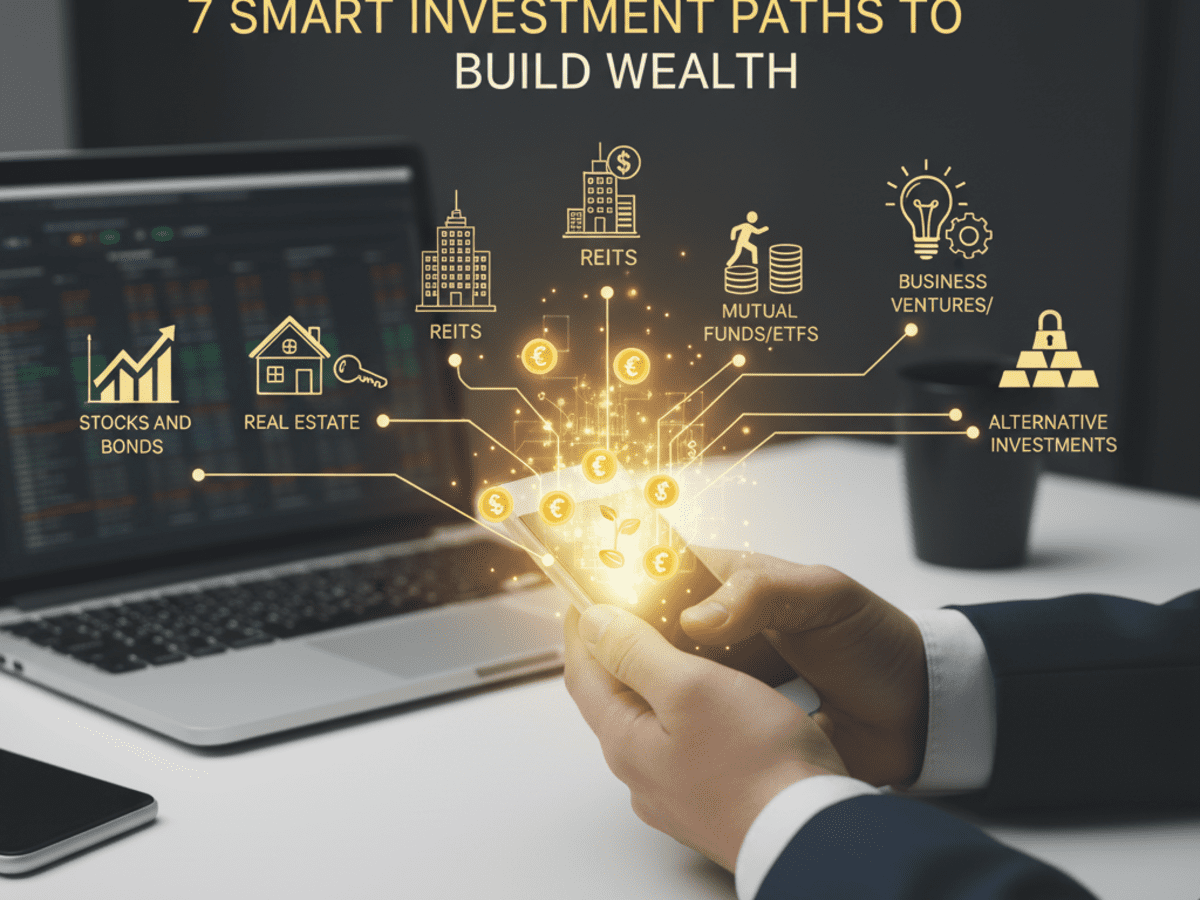

3. The Basics of Investing

You don’t need to wait until you're rich to invest.

Learning simple concepts like interest, compounding, diversification, and risk levels can open the door to long-term wealth.

4. Understanding Credit & Debt

Your credit score affects everything—from getting loans to renting an apartment.

Knowing how credit works, how to avoid high-interest debt, and how to repay loans smartly is a major part of financial literacy.

5. Creating a Personal Budget

A budget is simply a plan for your money.

It helps you stay organized, reduce overspending, and reach your financial goals faster.

6. Setting Short- and Long-Term Goals

Whether you want to buy a car, start a business, or build wealth, clear goals give your money purpose.

Financial literacy teaches you how to align your actions with your goals.

7. Protecting Your Future

Many people ignore insurance, emergency funds, and retirement planning until it’s too late.

Knowledge in these areas helps you avoid financial shocks and stay prepared for life's uncertainties.

Final Thoughts

Financial literacy is not a one-time lesson—it’s a lifelong skill.

The more you learn, the better decisions you make, and the more control you gain over your financial life.

Start small, stay curious, and watch how your confidence with money grows.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0