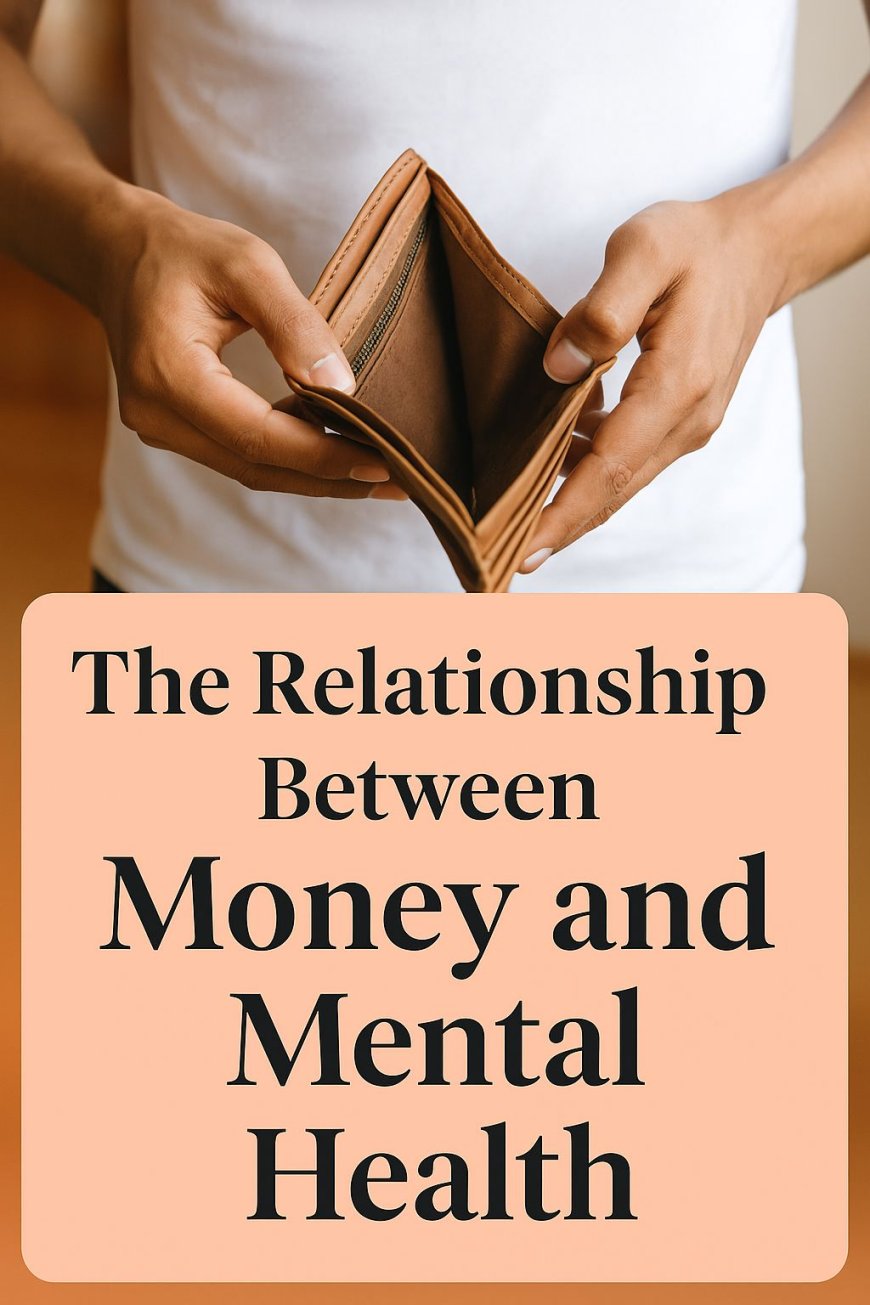

The relationship between money and mental health

This post explores the powerful connection between financial stability and mental health. It highlights how money challenges like debt, unemployment, or financial stress can contribute to anxiety, depression, and emotional distress. It also discusses how mental health issues can impact spending habits, decision-making, and earning potential. Understanding this two-way link is key to building both financial and emotional wellness

The Relationship Between Money and Mental Health: The Conversation We Never Really Have

Money isn’t just a currency.

It’s a mirror.

It reflects how we see ourselves, how safe we feel, and how much control we think we have in the world.

But here’s the part most people don’t say out loud:

Money doesn’t only affect your mental health, your mental health affects the way you handle money.

It’s a two-way street, and both sides shape each other more than we admit.

1. Money Shapes Your Sense of Safety

Before money becomes luxury, it becomes security.

When your mind doesn’t know where the next rent, school fee, or meal is coming from, it doesn’t think in straight lines, it thinks in alarms.

People talk about money stress, but we rarely talk about the psychological effects of uncertainty:

- Difficulty concentrating

- Overthinking

- Emotional withdrawal

- Feeling ashamed asking for help

- Feeling behind even when you are doing your best

Financial pressure doesn’t just sit in your bank account, it sits in your nervous system.

2. Mental Health Shapes Your Financial Behaviour

Here’s the part most people ignore:

Your emotional state influences:

- How you spend

- How you save

- What you buy

- What you tolerate

- How you negotiate

- When you’re anxious, you overspend for comfort.

- When you’re depressed, you procrastinate and avoid bills.

- When you lack confidence, you undercharge for your skills.

- When you’re overwhelmed, you ignore opportunities.

Money problems don’t always start with money. Sometimes they start with the mind.

3. Financial Trauma Is Real

Growing up around scarcity or financial instability can shape the way you respond to money as an adult:

- Feeling guilty for spending

- Feeling unsafe saving because life always happens

- Feeling unworthy of earning more

- Mistaking survival habits for personality traits

Some people didn’t learn to mismanage money, they learned to survive instability.

4. Emotional Wealth Matters Too

You can have money and still be mentally drained.

You can earn well but feel like you’re one bad month away from losing it all.

You can hit a financial milestone and still feel empty because your mind is running on fear, not fulfillment.

Money solves financial problems, but emotional wealth solves mental ones.

The real goal isn’t just to make money.

- It’s to feel safe with money.

- Confident with money.

- In control of money.

5. Healing Both Sides Is the Real Win

If money affects mental health, and mental health affects money, then the solution isn’t to fix one, it’s to work on both.

That looks like:

- Learning emotional regulation

- Unlearning financial fear

- Challenging scarcity beliefs

- Charging what your skill is truly worth

- Building a healthier money identity

Because when your mind is stable, your decisions are stronger.

And when your finances improve, your mind breathes better.

Conclusion:

Money and mental health are not enemies they’re partners.

The stronger one becomes, the stronger the other grows.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0